Environmental impact - Carbon accounting

Your Partner on your ESG transformation journey

The clock is ticking... The future will not wait.

Despite the legislative framework and its official implementation dates, market dynamics are pushing companies to run at a faster speed of implementation. The most conscious businesses and those that see the future more clearly (visionaries) have already begun their transition that will offer them a competitive advantage. The transition to a sustainable development strategy gives a unique opportunity to companies that will embrace it without waiting for the official implementation dates of the CSRD framework. Companies should consider how to identify, collect and evaluate ESG data, manage environmental, social and governance risks, and develop policies, setting achievable targets and follow relevant performance indicators (KPIs). Despite today’s macroeconomic and geopolitical challenges sustainable development gives companies the opportunity to grow and expand into new horizons with long term perspectives.

"If you don't measure it, you can't manage it."

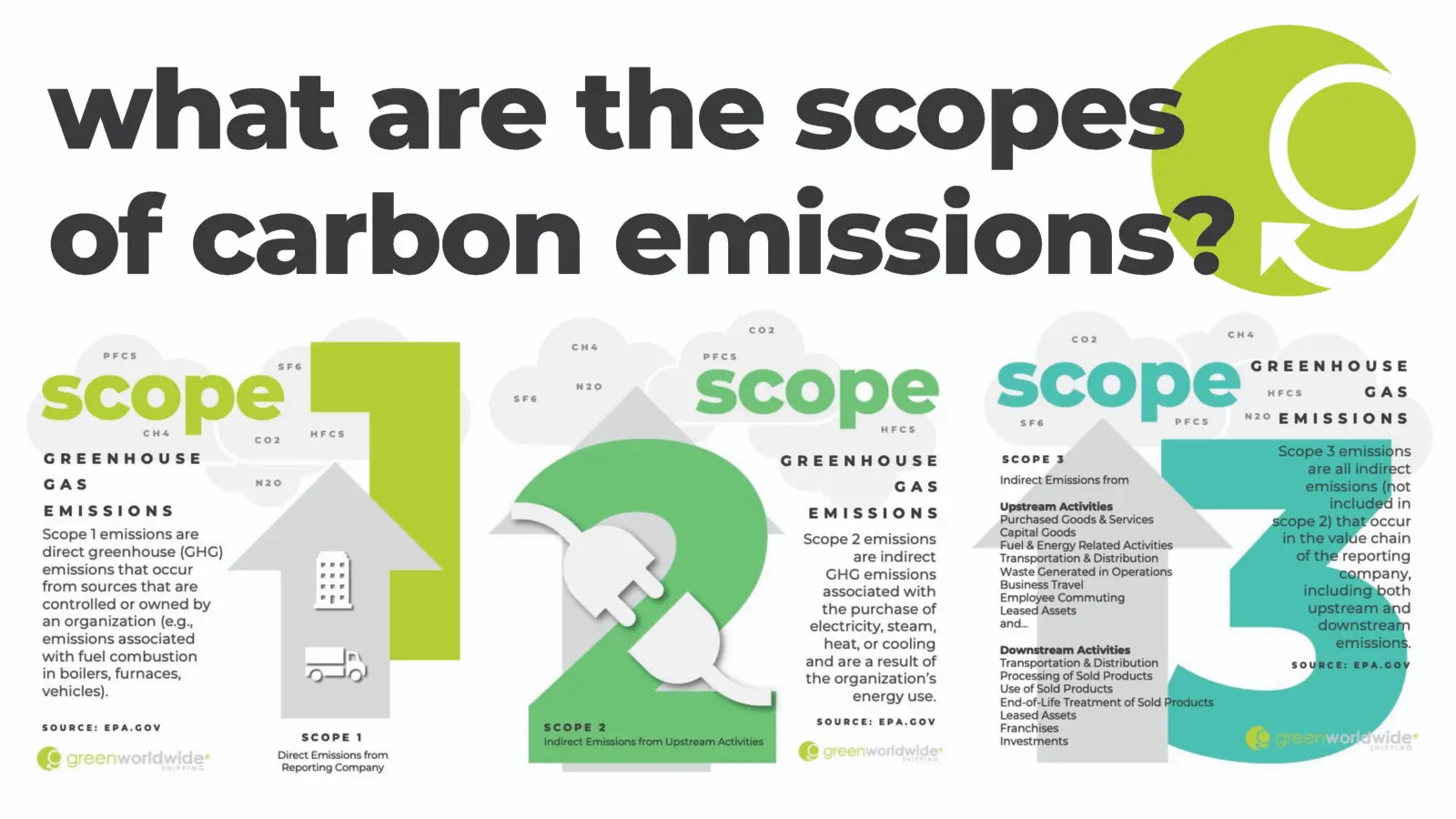

We offer specialized support to help companies prepare their carbon footprint reports. Under our environmental services, we specialize in the accurate calculation and reporting of carbon emissions across all scopes. Our dedicated team assists in measuring Scope 1 and Scope 2 emissions, as well as the more complex Scope 3 emissions, helping you to understand and manage your company’s broader environmental impact. Although not mandatory yet, the importance of tracking & reporting scope 3 emissions stems from the fact that one entity’s scope 3 may be another entity’s scope 1 & 2 emissions. Moreover, scope 3 covers all value chain emissions, which typically make up the majority of companies’ emissions (for banks & asset managers >90%) and are the hardest to track, reduce and mitigate. Our goal is to ensure that our clients not only comply with the latest regulations, but also showcase their commitment to sustainability through transparent and robust reporting.

NEW CLIMATE LAW - CARBON FOOTPRINT

On May 26, 2022, the Greek Parliament passed law 4936/2022 entitled "National Climate Law - Transition to climate neutrality and adaptation to climate change. The National Climate Law sets as its long-term goal the gradual transition of the country to climate neutrality by the year 2050, in the most environmentally sustainable, socially fair and cost-effective way. In order to achieve the long-term objective of climate neutrality, intermediate climate objectives are set out for the reduction of net anthropogenic greenhouse gas emissions compared to 1990 levels by at least:

- Fifty-five percent (55%) by the year 2030.

- Eighty percent (80%) by the year 2040.

In order to pursue the goal of climate neutrality, the law details the development of five-year carbon budgets for various sectors of the economy: electricity and heat production, industry, transport, agriculture, buildings, waste, and land use & forestry, as well as all ASE listed companies. These sectoral carbon budgets will allow the government to monitor and adjust emissions targets on a continuous basis, providing for even tougher goals in the future. Among all requirements is an annual carbon footprint report having third party assurance.

Carbon Accounting is implemented in line with ISO 14064 and the GHG Protocol, which are the two most well-known and broadly recognized carbon accounting standards. These two standards complement each other. Organizations can benefit from adopting both standards, as the ISO 14064 guides on what to measure and the GHGP on how to measure when compiling GHG inventories.

Carbon Border Adjustment Mechanism (CBAM)

Overview of CBAM

The European Union’s CBAM regulation, effective since May 17, 2023, targets specified imports across six emissions-intensive sectors. Its transitional period, from October 1, 2023, to December 31, 2025, focuses on data collection to refine CBAM for its definitive phase starting January 1, 2026.

Reporting Obligations

Quarterly reporting requirements entail details on imported CBAM goods, embedded emissions, and carbon pricing. The transitional phase emphasizes reporting without financial adjustments, aiding in fine-tuning CBAM obligations.

Rules and Methodologies

The EU methodology, determining embedded emissions, will become mandatory from January 1, 2025. Until December 31, 2024, alternative reporting methods exist for flexibility, ensuring compliance during the initial phase.

Compliance and Penalties

Compliance and Penalties Non-compliance penalties, tied to unreported emissions, range from EUR 10 to EUR 50 per tonne. The CBAM Transitional Registry facilitates data exchange and compliance monitoring.

Preparation and Implications

Businesses need readiness for CBAM obligations starting October 1, 2023. Understanding emission sources, supply chain dynamics, and potential cost impacts becomes critical.

Challenges and Solutions

Compliance demands robust emission tracking systems. Entities must adapt to EU Methodology by January 1, 2025. Long-term challenges include competitive assessment based on product carbon content.

Role of Net Zero Analytics (NZA)

NZA supports clients in preparing for carbon markets, compliance, and carbon management improvements. Services include advisory support for carbon management strategies, risk assessments, and legal impact evaluations. NZA aids in assessing risks, opportunities, and impacts on business performance across supply chains.