GAR (Green Asset Ratio)

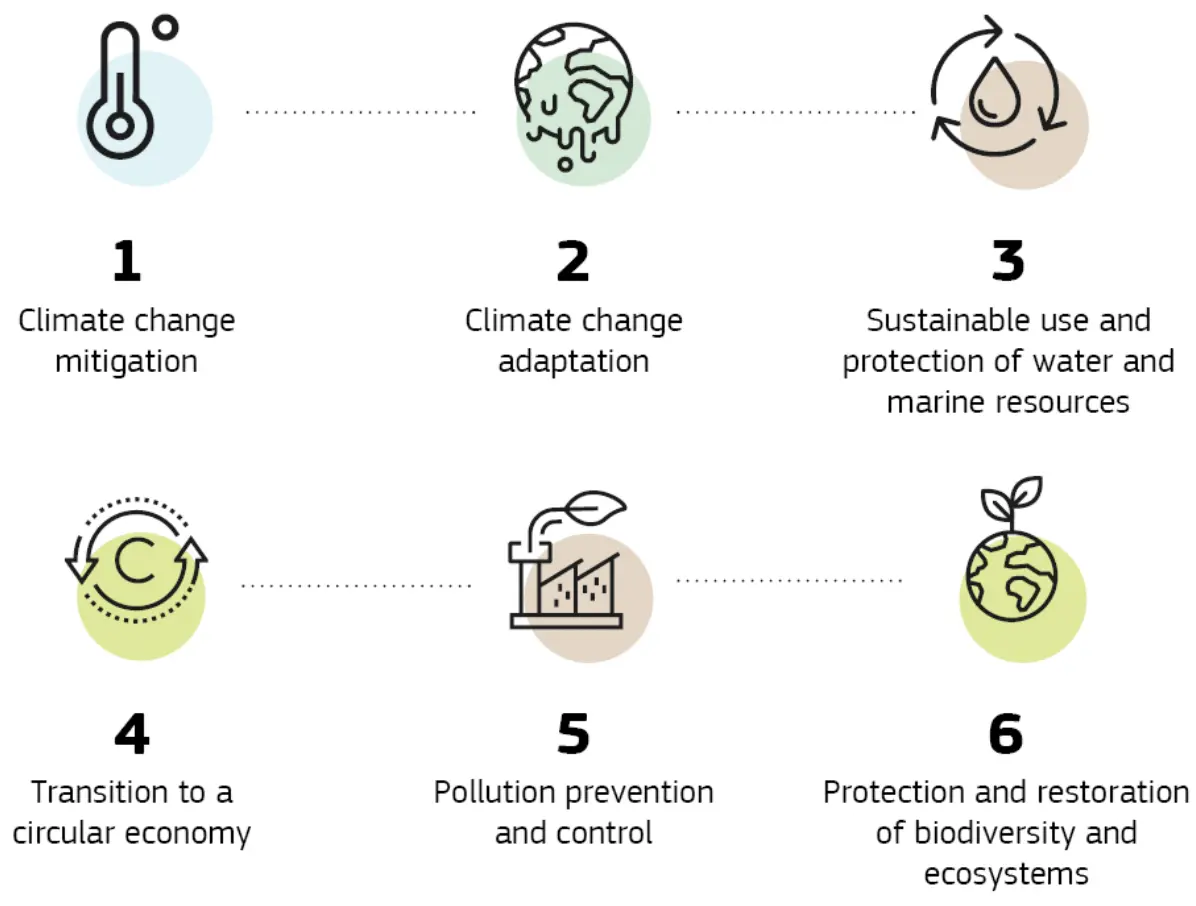

In January 2024, EU banks will have to disclose their Green Asset Ratio (GAR) for the financial year 2023. This means that banks will need to provide quantifiable evidence that demonstrates the extent to which the activities they finance meet what the EU Taxonomy defines as sustainable.

The implications for banks’ balance sheet and product strategy

In general, the climate risks on banks’ balance sheets and the effectiveness of their transition plans will affect stakeholders’ assessments of the banks’ business strategy and financial resilience, potentially affecting their share price or credit rating, and in turn access to and cost of capital and funding. As a summary measure of greenness, the GAR could in turn be adopted as a key determinant in the assessments by equity and debt investors. Investors may rely on banks’ GARs to identify green finance leaders and laggards, and a low outlier could serve as a red flag against a bank’s ESG characteristics.