Ecoverse

The first ESG data management platform

Specially designed to meet the requirements of Financial Institutions.

Ready to get started?

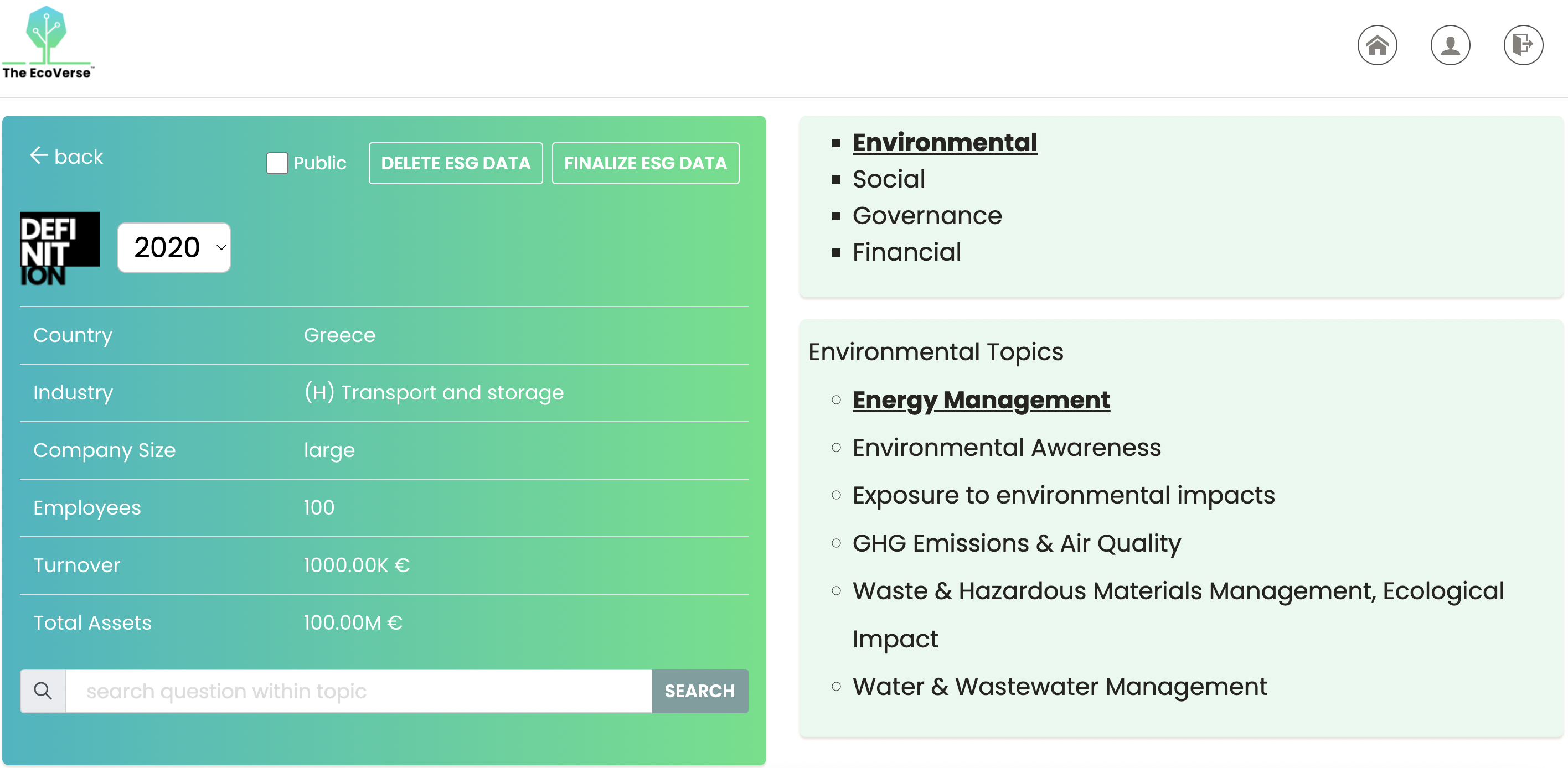

FIs have access to structured ESG metrics of market participants enabling them to meet regulatory expectations. Ecoverse is a significant tool for any FI in their strategic alignment of sustainability financing.

Commercial BanksInvestment BanksStartups 💡Businesses ✏️Large Corporations 📝Credit Unions

AI

ESG

Data analytics

Strategy

Sustainability

Diversity

Equality

Community

Human rights

Emissions

Water management

Labor standards

Executive compensation

Green finance

NZA uses Machine Learning (ML) to automate analytical model building. With the use of ML, systems can learn from data, identify patterns and make decisions with minimal human intervention.

The Ecoverse

Banks ought to approach ESG risks in a holistic fashion when embedding them into their risk management frameworks. This process includes adjusting business and risk strategies and corresponding risk appetite statements, making sure roles and responsibilities are fully transparent throughout all three lines of defense. Besides embedding ESG into risk frameworks, banks need to consider related issues in product design, pricing and sales decisions. Also, an appropriate consideration of ESG risks in a wide range of change processes is of vital importance for fostering profitability. This constant flow of new regulations is bringing extensive compliance challenges for banks. Ecoverse can help banks to master those challenges.